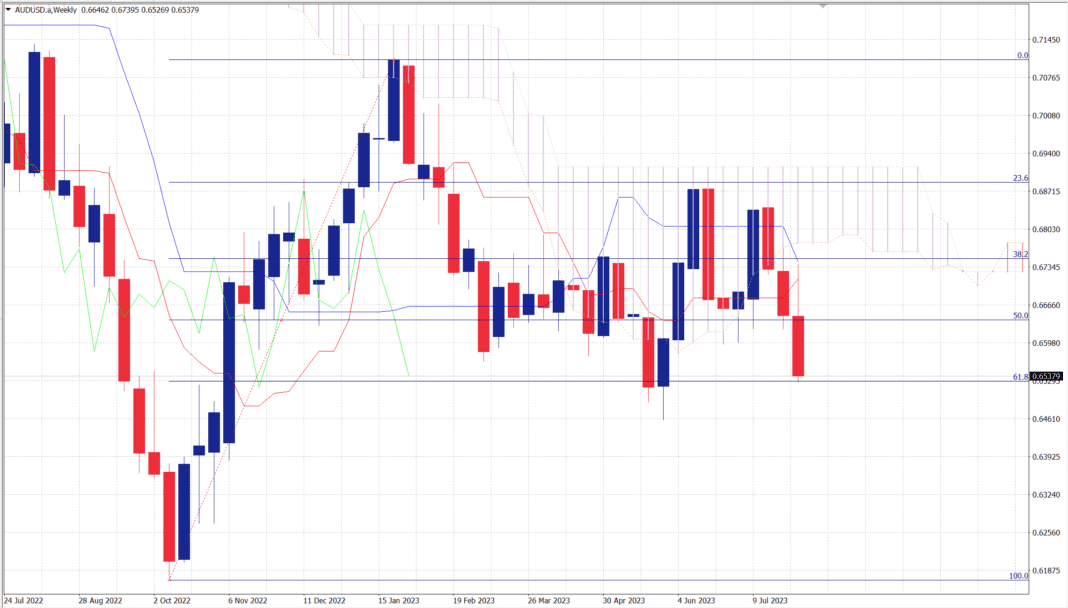

The Australian Dollar to US Dollar (AUDUSD) currency pair has recently witnessed a significant development on its daily chart, signaling a shift in market sentiment. The price has breached a crucial swing area ranging from 0.65468 to 0.65847, with an additional area of interest noted around 0.6566. This breach suggests the potential for further downside movement in the pair.

Furthermore, the current price action indicates that the AUDUSD is trading below the 61.8% Fibonacci retracement level of the upward move from the 2022 low to the 2023 high, aligning precisely with the mentioned key swing area at 0.65468. This confluence strengthens the significance of the level and suggests increased selling pressure in the market.

Implications for Traders

The breach of the key swing area and the 61.8% retracement level carries important implications for forex traders:

- Bearish Momentum: The move below the swing area and the 61.8% retracement level indicates a shift in sentiment towards the downside. Traders may expect bearish momentum to persist until the price demonstrates a clear reversal.

- Resistance Turned Support: As the breached swing area becomes resistance-turned-support, traders will closely monitor how the price reacts around this level. A potential retest and rejection could confirm the strength of the bearish bias.

- Potential Targets: With the breach of significant support levels, traders may set their sights on lower price targets. Technical analysis tools, such as Fibonacci extensions or previous swing lows, could be used to identify potential downside targets.

- Caution on Reversals: Traders anticipating a reversal should exercise caution until a clear signal is seen. A decisive move back above the breached support zone would be needed to invalidate the bearish bias.

Key Takeaway

The AUDUSD’s move below the key swing area and the 61.8% retracement level on the daily chart signals a bearish shift in sentiment. Traders should closely monitor price action around the breached level for potential confirmation of the bearish bias. As always, risk management remains crucial, and traders are encouraged to employ appropriate risk-reward ratios and stop-loss levels in their trading strategies.

Please note that forex markets can be highly volatile, and it is essential to stay updated with the latest developments and news that may impact currency movements. Always conduct thorough research and analysis before making trading decisions, and consider seeking advice from professional financial advisors if needed.

DISCLAIMER: The content provided above is for informational purposes only and should not be considered as financial advice. Trading forex carries a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results.