Welcome to our blog, where we explore the concept of “Lean Forex Trading” and how it can help you optimize your trading strategies for maximum efficiency and profitability. Lean forex trading is about simplifying your approach, focusing on key factors, and eliminating unnecessary complexities to achieve consistent success in the forex market. Let’s dive into the core principles of lean trading and discover how you can apply them to your trading journey.

1. Embracing Simplicity:

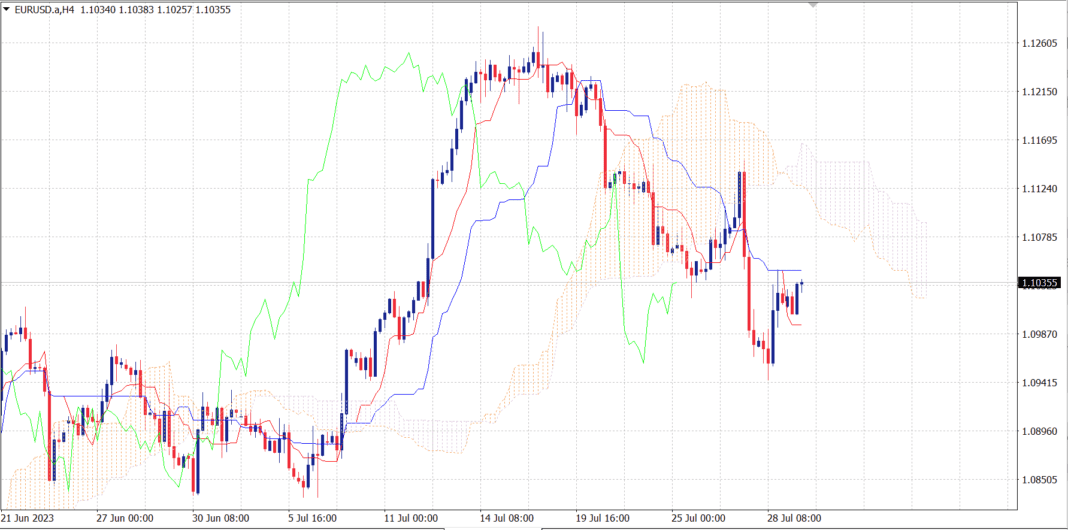

Lean forex trading emphasizes the importance of simplicity in your trading strategies. Instead of using numerous indicators and complex trading systems, focus on a few key indicators and price action analysis to identify trading opportunities. Keep your trading charts clean and uncluttered, allowing you to make quick and decisive decisions without being overwhelmed by excessive information.

2. Prioritizing Key Factors:

In lean trading, it’s essential to identify and prioritize the key factors that influence currency price movements. Fundamental factors such as economic indicators, central bank policies, and geopolitical events can significantly impact the forex market. Combine this with technical analysis to create a well-rounded approach that helps you make informed trading decisions.

3. Risk Management as a Cornerstone:

Lean forex trading places a strong emphasis on risk management. Determine your risk tolerance and set appropriate stop-loss levels for each trade. By managing your risk effectively, you protect your capital from significant losses and create a solid foundation for consistent gains.

4. Trade with Discipline:

Maintaining discipline is crucial in lean forex trading. Stick to your trading plan, avoid impulsive decisions, and don’t let emotions dictate your trades. Follow your predetermined entry and exit points, and avoid chasing after the market. Patience and discipline will lead to better trading outcomes.

5. Quality Over Quantity:

Lean forex trading is not about making as many trades as possible; it’s about making high-quality trades with a favorable risk-to-reward ratio. Wait for the right setups, and only enter trades that align with your trading strategy and meet your criteria.

6. Continuous Learning and Improvement:

Stay committed to learning and improving your trading skills. Keep a trading journal to track your trades and analyze your performance regularly. Learn from both your winning and losing trades to refine your approach continually.

7. Adaptability and Flexibility:

Lean trading also means being adaptable and flexible in response to changing market conditions. Forex markets can be dynamic, and what works well in one situation may not be as effective in another. Be open to adjusting your strategies as needed to stay ahead in the ever-changing forex landscape.

Conclusion:

Lean forex trading is all about efficiency, simplicity, and a disciplined approach. By focusing on key factors, managing risk, and staying committed to continuous improvement, you can streamline your trading process and increase your chances of achieving consistent profits in the forex market. Remember that trading involves risk, and no approach can guarantee success, but with lean trading principles, you can build a robust foundation for your forex trading journey. Happy trading!