Divergence, a powerful concept in the realm of technical analysis, serves as a strategic compass for traders seeking to navigate the complex terrain of financial markets. It’s a tool that unveils hidden nuances within price movements, shedding light on potential trend reversals or extensions. Understanding divergence is akin to deciphering the language of the markets, where subtle cues can make all the difference in making successful trading decisions.

At its core, divergence is a reflection of the tug-of-war between price action and a chosen technical indicator. It comes into play when these two essential components of market analysis move out of sync. In essence, it’s a battle of momentum, and spotting this discordance can be a game-changer for traders.

The Basics of Divergence

Picture this: You’re analyzing a stock, currency pair, or any tradable asset on your charting platform. As you scrutinize the price movements, you’re also keeping an eye on a selected technical indicator, like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD). This indicator serves as your compass, guiding you through the market’s twists and turns.

However, the magic of divergence happens when this guiding compass starts to disagree with the price action. Here’s how it plays out:

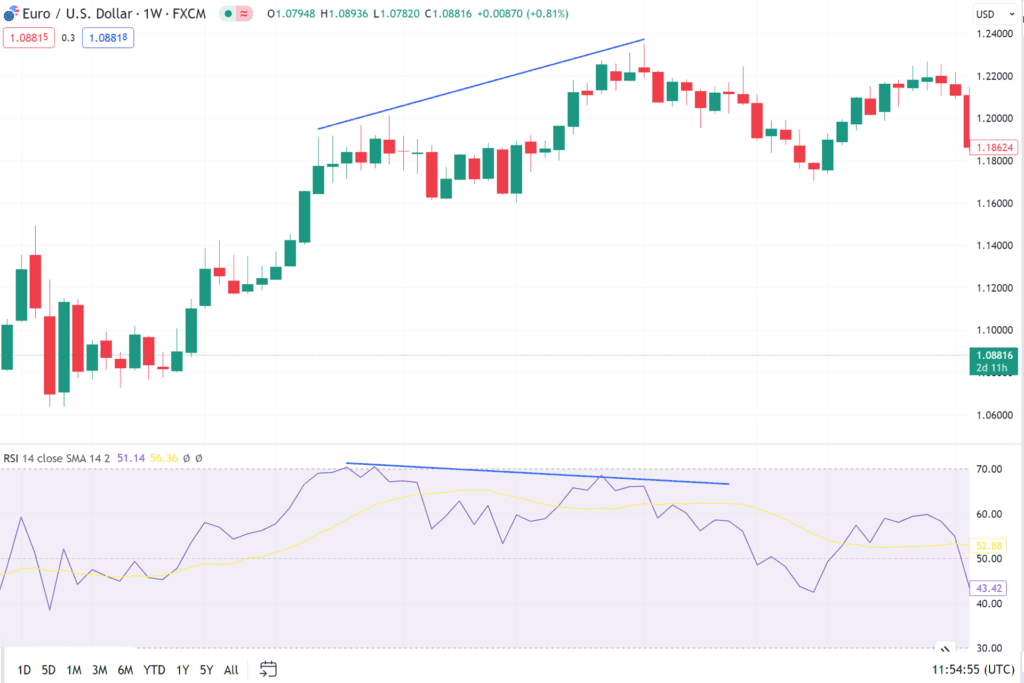

- Bearish (Negative) Divergence: This scenario unfolds when the price of the asset reaches new highs, suggesting an uptrend, but your chosen indicator fails to mirror this enthusiasm. Instead, it either flattens out or starts to trend downwards. This divergence implies that the bullish momentum may be waning, and a potential trend reversal or correction could be on the horizon.

- Bullish (Positive) Divergence: Conversely, bullish divergence materializes when the price hits new lows, indicating a potential downtrend. Yet, your indicator refuses to follow suit and starts showing higher readings. In this case, it suggests that despite the prevailing bearish sentiment, there’s an underlying strength building up, hinting at a possible trend reversal to the upside.

The Power of Hidden Divergence

Now, while regular divergence can be a potent signal on its own, hidden divergence adds another layer of complexity and insight to the mix. Hidden divergence occurs when the price and your chosen indicator move in opposite directions but align with the prevailing trend. Let’s explore this concept further:

- Bullish (Positive) Hidden Divergence: In the midst of an uptrend, you might notice that the price retraces slightly, forming a higher low. At the same time, your indicator dips and creates a lower low. This hidden divergence suggests that, although there’s a temporary pullback in price, the overall bullish trend remains robust, potentially providing an opportunity to enter or stay in a long trade.

- Bearish (Negative) Hidden Divergence: Conversely, during a downtrend, you may observe the price attempting a minor recovery, forming a lower high. Simultaneously, your indicator starts climbing, recording a higher high. This hidden bearish divergence signifies that despite the temporary upward move, the underlying bearish pressure is still dominant, hinting at the potential continuation of the downtrend.

The Art of Divergence Trading

Traders harness divergence as a tool to make more informed decisions. It’s a means of looking beneath the surface of price action to gauge the strength of market sentiment. However, like any tool in trading, it should be used judiciously and in conjunction with other forms of analysis.

When identifying divergence, it’s essential to validate your observations with other technical indicators, trendlines, or support and resistance levels. This multi-faceted approach helps filter out false signals and enhances the reliability of your trading decisions.

In conclusion, divergence is more than just a concept in technical analysis; it’s a dynamic and actionable tool that traders employ to gain insights into the intricate dance of market forces. It’s a reminder that beneath the surface of price charts lies a world of hidden information, waiting for those who have the skills to decode it.